Svetlana Dimitrakieva

ORCID iD: 0000-0001-9639-9957

Technical University of Varna, Bulgaria

Ergun Gunes

Chartered Shipbroker, Essex Shipping Services, United Kingdom

Christiana Atanasova

ORCID iD: 0000-0003-2102-037X

Nikola Vaptsarov Naval Academy, Varna, Bulgaria

https://doi.org/10.53656/igc-2024.11

Pages 72-83

Abstract. The paper aims to analyze the impact of meteorological and geopolitical disruptions on the main shipping checkpoints. Globalization is predicated on the free international movement of goods, essential for international trade. Those goods’ delivery relies on specific trade routes and checkpoints, which have always been critical passages for the carriage of goods by sea. On the other hand, any disruption at those checkpoints can have detrimental consequences for the global economy. Any disruption can significantly impact global trade, leading to delays, increased shipping costs, and potential shortages of goods. The impact of those disruptions could also create substantial economic damages, as those passages are crucial for planning for the future and will always be a primary global concern. Although the checkpoints provide a lot of economic advantages, their vulnerability and the lack of physical security invariably endanger shipping and international trade.

Keywords: checkpoints; channels; natural disasters; piracy; disruptions; geopolitical conflicts

JEL: A1, F1, R4, L91

- Introduction

The maritime industry and commercial fleet operation occupy a pivotal position in the global economy, providing essential services and resources for international trade and transportation. This industry boasts a rich history, having evolved over centuries. Throughout its existence, it has served as an engine for economic growth and cultural exchange between diverse regions of the world (Biolcheva & Valchev, 2023). In the contemporary context of intensified international cooperation and economic globalization, the issue of international transportation corridors demands particular attention in both national and international policymaking (Conev & Dimitrakiev, 2023). The organization of transportation corridors hinges on the concentration of freight, transportation, and passenger flows in a specific direction, necessitating high productivity and a well-developed infrastructure.

Artificial waterways worldwide have revolutionized international shipping by shortening transportation routes and reducing operational costs (Rodrigue, 2016). The Suez Canal in Egypt, for instance, stands as one of the most critical waterways globally, connecting North America, Europe, and the Mediterranean Sea with the Middle East and Asia (Dimitrakiev & Gilev. 2021). It serves as a pivotal transportation channel for a multitude of commodities, including petroleum and natural gas. The Suez Canal is indispensable for maritime navigation.

In this context, the article investigates the impact of the disruptions of the global check points on the seaborne trade. The primary focus of the research centers on the Panama and Suez Canals as paramount global maritime routes.

- Suez and Panama Canals Disruptions

The Suez Canal is the shortest link between Asia and Europe and the fastest route between the Atlantic and Indian Oceans. It is also the longest canal without locks, with a transit time from one end to the other ranging from 13 to 15 hours.The key maritime route handles about 15% of global shipping. During the crisis, Egypt loses $15 million a day. The container ship Ever Given ran aground on March 23, 2021. After the case was resolved, oil prices fell by 1%. However, ship and cargo owners face additional costs due to the lack of insurance for the incident. Supply chains were disrupted (Koritarov & Dimitrakiev, 2021). Many carriers also suffer losses due to rerouting ships around the Cape of Good Hope.

For the fiscal year 2022/2023, ending in June, Egypt’s revenue from the canal reached $8.8 billion. Traffic on this key trade route decreased by 30% between January 1 and 11, 2024, compared to the same period the previous year. 544 vessels have passed through the canal since the beginning of 2024, compared to 777 during the same period in 2023.

For March 2024, on an annual basis, revenues from passing ships through the canal have halved. Nonetheless, it should be noted that for the first quarter of 2023, revenues from passing ships set a historical record. The decline in cargo traffic through the Suez Canal is mainly due to the constant attacks by Yemeni Houthi rebels on commercial vessels in the Red Sea. In mid-November 2023, the Houthis announced they would target sites associated with Israel, including commercial ships. A Houthi spokesperson stated that they would obstruct ships traveling to Israel, regardless of their flag.

A combination of climate change and infrastructure issues is responsible for critical delays in maritime traffic through the Panama Canal. Remnants of ancient forests highlight the severity of the situation in the drought-stricken Panama Canal. Just a few hundred meters from the massive ships carrying goods worldwide, dried stumps rise above the waterline. They are all that remains of a forest that was flooded more than a century ago to create the canal. It is not uncommon to see these stumps during the height of the dry season (Carse, 2012). They are a visible reminder of how dry conditions have crippled a waterway that handles $270 billion in goods annually from around the world. There are no easy solutions. The Panama Canal Authority is considering potential solutions, including creating an artificial lake to pump water into the canal and cloud seeding to increase rainfall, but both options would take years to implement, if they are feasible at all.

With water levels standing 1.8 meters below normal, canal authorities are reducing the number of vessels that can transit the canal. Some shippers pay millions of dollars to expedite their place in the growing queue, while others opt for longer and more expensive routes around Africa or South America.

Subsequently, the restrictions have been slightly eased, but with a maximum of 24 ships passing per day, the current limit is well below the pre-drought daily capacity of around 38. As the dry season continues, the situation is likely to worsen again.

The canal’s difficulties reflect how climate change is altering global trade flows. Drought is causing problems on the Mississippi River in the U.S. and the Rhine in Europe. In the United Kingdom, rising sea levels increase the risk of flooding along the Thames. Melting ice is creating new maritime routes in the Arctic.

Under normal circumstances, the Panama Canal handles about 3% of global maritime trade volumes and 46% of the containers moving from Northeast Asia to the U.S. East Coast. Transit of vessels through the Panama Canal has decreased by 49% from its maximum, mainly due to falling water levels.

The canal is Panama’s largest revenue source, generating $4.3 billion in 2022. According to UNCTAD data, peak shipping was recorded in January 2022, after which transit through the canal gradually decreased (UNCTAD, 2024). The situation is also influenced by the El Niño phenomenon, associated with temperature fluctuations in the surface layer of water in the equatorial part of the Pacific Ocean.

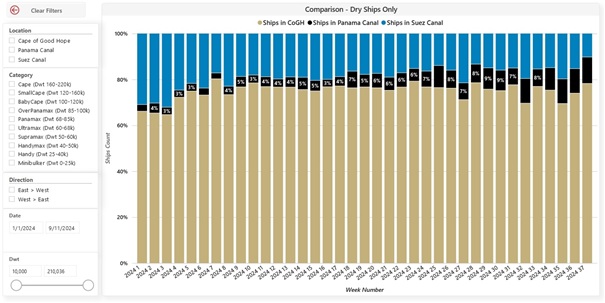

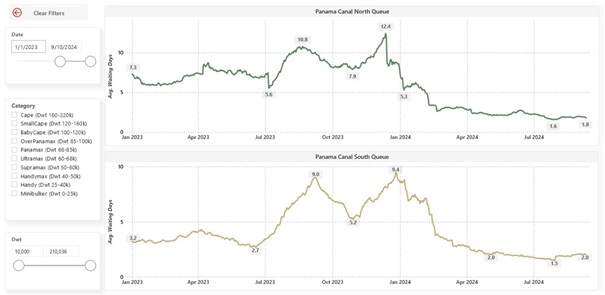

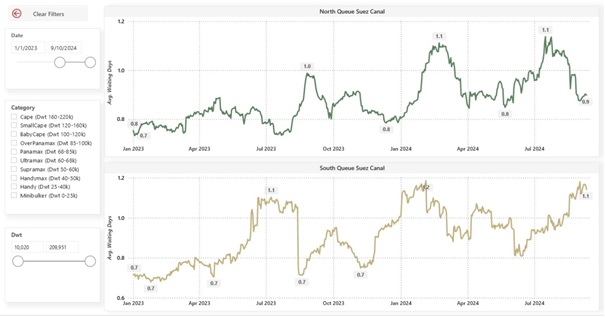

Waiting times, which are usually between three and five days, sometimes extend to 19 days. The Canals Traffic & Congestion tool in AXSInsights from AXSMarine can illustrate these data. It provides daily information obtained from AIS on bulk carriers in the Panama and Suez Canals, as well as their respective waiting areas (Ahmed et al., 2018). The report also allows filtering for specific locations within the canal zones, ship sizes, and their current directions. It also enables comparison of daily traffic and monitoring of percentage changes in movement between Panama and Suez (El Sakty, 2020), as well as rerouting around the Cape of Good Hope (Fig. 1).

Figure 1. Comparison Cape of Good Hope – Suez Canal Source: AXSMarine reports

- Most Affected Segment of the Global Merchant Fleet Due to Red Sea Crisis

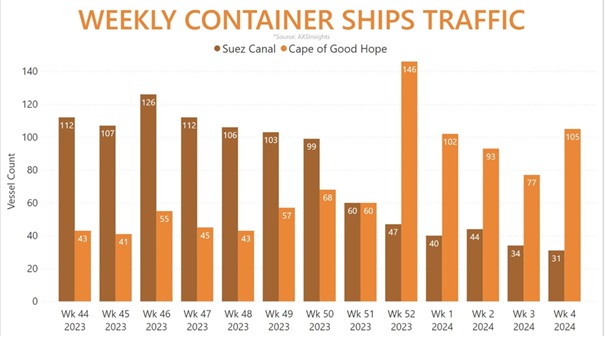

The segment most affected in percentage terms is that of container ships (Gancheva, 2021). Between November 2023 and January 2024, container ship traffic through the Suez Canal decreased by approximately 75%, with the number of ships passing through the canal dropping from over 120 in mid-November to just over 30 in January. As a result, the number of container ships transiting around the Cape of Good Hope increased from an average of fewer than 50 ships per week in November to over 100 ships per week by the end of December.

Figure 2. Weekly container ships traffic Source: AXSMarine reports

Bulk carriers, which predominantly transport Brazilian iron ore and grain to China via the Cape of Good Hope, appear to be the least affected by the Red Sea crisis. Before the crisis began, fewer than 200 ships from this market segment passed through the Suez Canal weekly, with their number dropping to just over 110 in the last week of January, marking a 42% decrease. Over the past five weeks, the number of ships transiting around the Cape of Good Hope has increased to over 320 per week. Although the container ship segment is the most affected by the Red Sea crisis in weekly percentage terms, the overall number of bulk carriers and tankers rerouted around the Cape of Good Hope is actually higher.

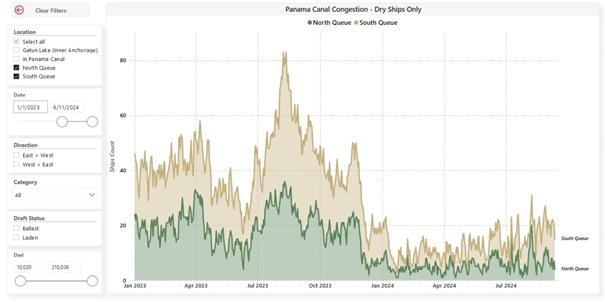

Figure 3. Panama canal congestion Source: AXSMarine reports

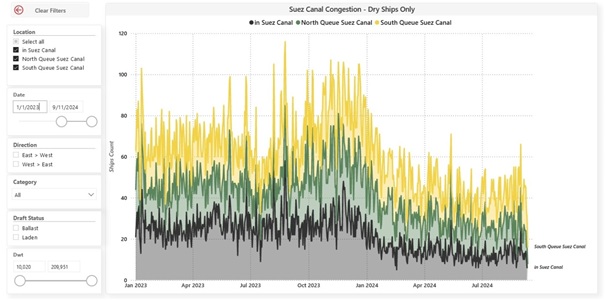

Figure 4. Suez canal congestion Source: AXSMarine reports

Waiting time is a 30-day rolling average and is calculated based on all bulk carriers, both booked and unbooked, waiting at the respective anchorage points to transit through the Panama Canal. Waiting time can vary depending on the size of the ship, whether it is booked or not, and whether it is transiting through the old or new locks of the canal.

Egypt’s revenue from the transit of ships through the Suez Canal for the fiscal year 2023/24 (ending June 30) has decreased by 23.4%, Reuters reports, citing a statement from the Canal Authority’s Chairman, Osama Rabie. Revenues from the Suez Canal for the period from July 1, 2023, to June 30, 2024, amount to $7.2 billion, compared to $9.4 billion for the previous fiscal year 2022/23. Meanwhile, the number of ships transiting the canal in the year has decreased from 25,900 (in fiscal year 2022/23) to 20,100 (in fiscal year 2023/24), marking a 22% drop.

Figure 5. Panama canal wait time Source: AXSMarine reports

Figure 6. Suez wait time Source: AXSMarine reports

Comparing other periods, the decline in cargo traffic through the Suez Canal is even greater. For the entire calendar year 2023 compared to the previous year, the decrease is 28%. For January of this year compared to the same month in the previous year, revenues have fallen by 47%.

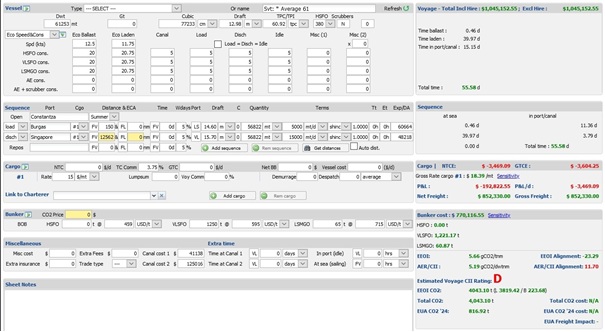

- Voyage Estimation

Speed has always been a crucial factor in shipping, but in the modern era of digitization, it has become essential. The calculator in AXSMarine is the preferred option when a detailed examination of shipping costs is required. The module also provides an alternative for optimizing speed. The process of evaluation and analysis helps shipping companies manage and optimize their financial results from voyages, thereby improving profitability and operational efficiency. Voyage performance evaluation (or operational voyage estimation) is a critical tool for analyzing and managing the financial results of ship operations. Voyage distances are crucial for the estimation, as they contribute to defining the length of the sea journey, including ballast transit. Incidents such as the grounding of the container ship Ever Given, although rare, have occurred in the Suez Canal before. In this context, it has become necessary to choose alternative transport routes.

For greater clarity, we perform calculations for a standard type of ship transiting once through the Suez Canal and another time around the Cape of Good Hope. The distances for the two routes are visualized in Fig. 7 and Fig. 8.

Maritime cargo transportation is a complex process involving many participants from different countries and continents. It is no coincidence that many authors emphasize the need to use tools that adhere to modern techniques, especially those based on technology (Sterev, 2023). In this regard, AXS Marine is a leader in providing innovative solutions that can be effectively used by maritime professionals (Dimitrakiev & Molodchik, 2018; Koritarov, 2021). AXS Marine offers information on current market conditions, routes, and other factors that impact the commercial operation of ships. It also provides analyses and statistics on shipping markets. This is why this comprehensive platform was used for the current calculations.

Figure 7. Estimation via Suez Canal Source: AXSMarine reports

Figure 8. Estimation via Cape of Good Cope Source: AXSMarine reports

It is important to note again that calculating the financial result is a complex task and involves numerous financial factors and variations depending on the specific voyage and conditions. Therefore, maritime professionals and ship managers rely on extensive experience and specialized software tools to perform these calculations accurately and efficiently.

- Conclusions

The Suez Canal is the shortest maritime route between Asia and Europe, connecting some of the largest consumers and suppliers of goods on both continents. Today, more than 30,000 ships under the flags of over 100 countries pass through the Suez Canal each year. Collectively, they transport about 300 million tons of various goods. Fourteen percent of the global trade volume transits the canal, with most of the oil traffic moving from the Persian Gulf region to Europe and America.

During the fiscal year 2007 – 2008, the Suez Canal achieved record revenues of $5.113 billion, nearly $1 billion more than in previous years.

It is suggested that shipowners might consider using the Northern Sea Route as an alternative to the transport arteries passing through the Suez and Panama Canals, but this would delay the delivery of goods and increase transport costs (Wang, Zhang & Meng, 2018).

However, it remains a fact that a significant portion of trade between European and South Asian countries is tied to the Suez Canal, along with the associated costs and delivery speed. Therefore, this option will maintain its priority in the near future. The assessment of the medium-term outlook proves that the Suez Canal and the Panama Canal cannot currently be replaced.

REFERENCES

Ahmed, H. Z., Khan, N., Sajjad, S. & Ahmed, D. (2018). Evaluation of Strategic Importance of CPEC: A Comparative Study with Panama Canal Project and Suez Canal Project. Paradigms: A Research Journal of Commerce, Economics, and Social Sciences, 12(1), 128 – 119. https://doi.org/10.24312/paradigms120116

AXSMarine. Trade Flows & AXSInsights. AXSDry modules. https://public.axsmarine.com/axsdry/all-tools

Biolcheva, P. & Valchev, E., (2023). Safety through Artificial Intelligence in the Maritime Industry. Strategies for policy in science and education, 31(3), 270 – 280. https://doi.org/10.53656/str2023-3-3-saf

Carse, A. (2012). Natureas Infrastructure: Making and Managing the Panama Canal Watershed. Social Studies of Science, 42(4), 539 – 563.

Conev, I. & Dimitrakiev, D., (2023). Use of Modern Technologies at Naval Academy Varna. Proceedings of the International Association of Maritime Universities, 129 – 135. http://archive.iamu-edu.org/wp-content/uploads/2023/12/IAMU_Proceedings2023_Finalized_041223.pdf

Dimitrakiev, D. & Gilev, G., (2021). Green Ports – Environmental Challenges and Economic Demands. Pedagogika-Pedagogy, 93(7s), 132-140. https://doi.org/10.53656/ped21-7s.11gree

Dimitrakiev, D. & Molodchik, A.V. (2018). Digital Platforms as Factor Transforming Management Models in Business and Industries. Journal of physics: Conference series, 1015(4), 042040. https://doi.org/10.1088/1742-6596/1015/4/042040

El Sakty, K. G. A. (2020). A Comparison Study Between the Suez Canal and the Panama Canal on the International Container Shipping. Scientific Journal for Financial and Commercial Studies and Researches (SJFCSR), 1(2), 81 – 108.

Gancheva, Y., (2021). Some Problems Related to the Exploitation of Automated Container Rerminals. Pedagogika-Pedagogy, 93(7s), 122-131. https://doi.org/10.53656/ped21-7s.10cont

Koritarov, T., (2021). Application of Virtual Online Techniques in Maritime Education in a Pandemic – New Pedagogical environment and issues. In International Scientific Conference Innovative Education for Emerging Maritime Issues (pp. 63 – 69). Nikola Vaptsarov Naval Academy.

Koritarov, T. & Dimitrakiev, D., (2021). Unmanned Aerial Vehicles in Port Operations – Use Cases and Benefits. In International Scientific Conference Innovative Education for Emerging Maritime Issues (pp. 70-78). Nikola Vaptsarov Naval Academy.

Rodrigue, J.-P. (2016). The Geography of Transport Systems. Taylor & Francis.

Sterev, N., (2023). Pre-Incubation Toolkits for Academic Entrepreneurship Fostering: Bulgarian Case. Strategies for Policy in Science and Education, 31(3s), 90 – 103. https://doi.org/10.53656/str2023-3s

UNCTAD. (2024, February 22). Disruptions in Key Global Shipping Route – Suez Canal, Panama Canal, and Black Sea – Signal Unprecedented Challenges for Global Trade Affecting Millions of People in Every Region, [Press release]. https://unctad.org/press-material/disruptions-key-global-shipping-route-suez-canal-panama-canal-and-black-sea-signal

Wang, H., Zhang, Y. & Meng, Q., (2018). How Will the Opening of the Northern Sea Route Influence the Suez Canal Route? An Empirical Analysis with Discrete Choice Models. Transportation Research: Part A Policy and Practice, 107, 75 – 89.